nh food tax calculator

Provides nutrition benefits to eligible low-income individuals and families so they can purchase healthy food and move towards self-sufficiency. Some schools and students.

Everything You Need To Know About Restaurant Taxes

Use this app to split bills when dining with friends or to verify costs of an individual purchase.

. This marginal tax rate means that your immediate additional income will be taxed at this rate. 0 5 tax on interest and dividends Median household income. Average Local State Sales Tax.

For instance an increase of 100 in your salary will be taxed 3601 hence your net pay will only increase by 6399. Motor vehicle fees other than the Motor. In Texas prescription medicine and food seeds are exempt from taxation.

Vermont has a 6 general sales tax but an additional 10. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to. A 9 tax is also assessed on motor vehicle rentals.

Switch to New Hampshire salary calculator. Last updated November 27 2020. Enter your info to see your take home pay.

And all states differ in their enforcement of sales tax. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Take home salary calculator.

Your average tax rate is 217 and your marginal tax rate is 360. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. For the latest on COVID-19 in New Hampshire go to wwwcovid19nhgov.

A calculator to quickly and easily determine the tip sales tax and other details for a bill. A 9 tax is assessed upon patrons of hotels or any facility with sleeping accommodations and restaurants on rooms and meals costing 36 or more. Food tax in texas calculator The property tax is used to finance the States 254 counties over 1200 cities 1022 independent school districts and more than 1800.

Your household income location filing status and number of personal exemptions. Also check the sales tax rates in different states of the US. Unlike adjustments and deductions which apply to your income tax credits apply to your tax liability which means the amount of tax that you owe.

For example if you calculate that you have tax liability of 1000 based on your taxable income and your tax bracket and you are eligible for a tax credit of 200 that would reduce your liability. A 9 tax is also assessed on motor vehicle rentals. New Hampshire income tax rate.

54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. If you have any questions about tax-exempt sales please call the Departments Division of Taxpayer Services for clarification at 603 230-5030. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Find out if you may be eligible for food stamps and an estimated amount of benefits you could receive. Our income tax calculator calculates your federal state and local taxes based on several key inputs. After a few seconds you will be provided with a full breakdown of the tax you are paying.

New Hampshire Salary Tax Calculator for the Tax Year 202122 You are able to use our New Hampshire State Tax Calculator to calculate your total tax costs in the tax year 202122. This website is not affiliated with any government organizations. A 9 tax is assessed upon patrons of hotels and restaurants on rooms and meals costing 36 or more.

To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Meals paid for with food stampscoupons. This New Hampshire hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Designed for mobile and desktop clients. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85. Please note that effective October 1 2021 the Meals Rentals Tax rate is reduced from 9 to 85.

Meals and Rentals Tax Monthly Activity Reports - compiled and published by the NH Office of Strategic Initiatives For an up-to-date list of. This is an calculator and not an application. For additional assistance please call the Department of Revenue Administration at 603 230-5920.

If you are an Able-bodied Adult Without Dependants ABAWD work rules have been suspended. New Hampshires excise tax on cigarettes is ranked 17 out of the 50 states. The New Hampshire cigarette tax of 178 is applied to every 20 cigarettes sold the size of an average pack of cigarettes.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. The New Hampshire excise tax on cigarettes is 178 per 20 cigarettes higher then 66 of the other 50 states. SmartAssets New Hampshire paycheck calculator shows your hourly and salary income after federal state and local taxes.

Forms Documents. The State of New Hampshire does not issue Meals Rentals Tax exempt certificates. How Income Taxes Are Calculated.

November 28 2021 alison brie dave franco. New Hampshire Hourly Paycheck Calculator.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Third Party Delivery Apps Can Boost Sales And Sales Tax Complexity

New Hampshire Income Tax Calculator Smartasset

New Hampshire Sales Tax Rate 2022

7 Free Printable Budget Worksheets

Your Data Entry Resume Is The Essential Marketing Key To Get The Job You Seek The Resume Including For The D Data Entry Clerk Sample Resume Job Resume Samples

Cut To Meals And Rooms Tax Takes Effect Nh Business Review

Great Bay Food Truck Festival Town Of Stratham Nh

New Hampshire Sales Tax Rate 2022

6 Piece Chicken Mcnuggets Happy Meal Mcdonald S

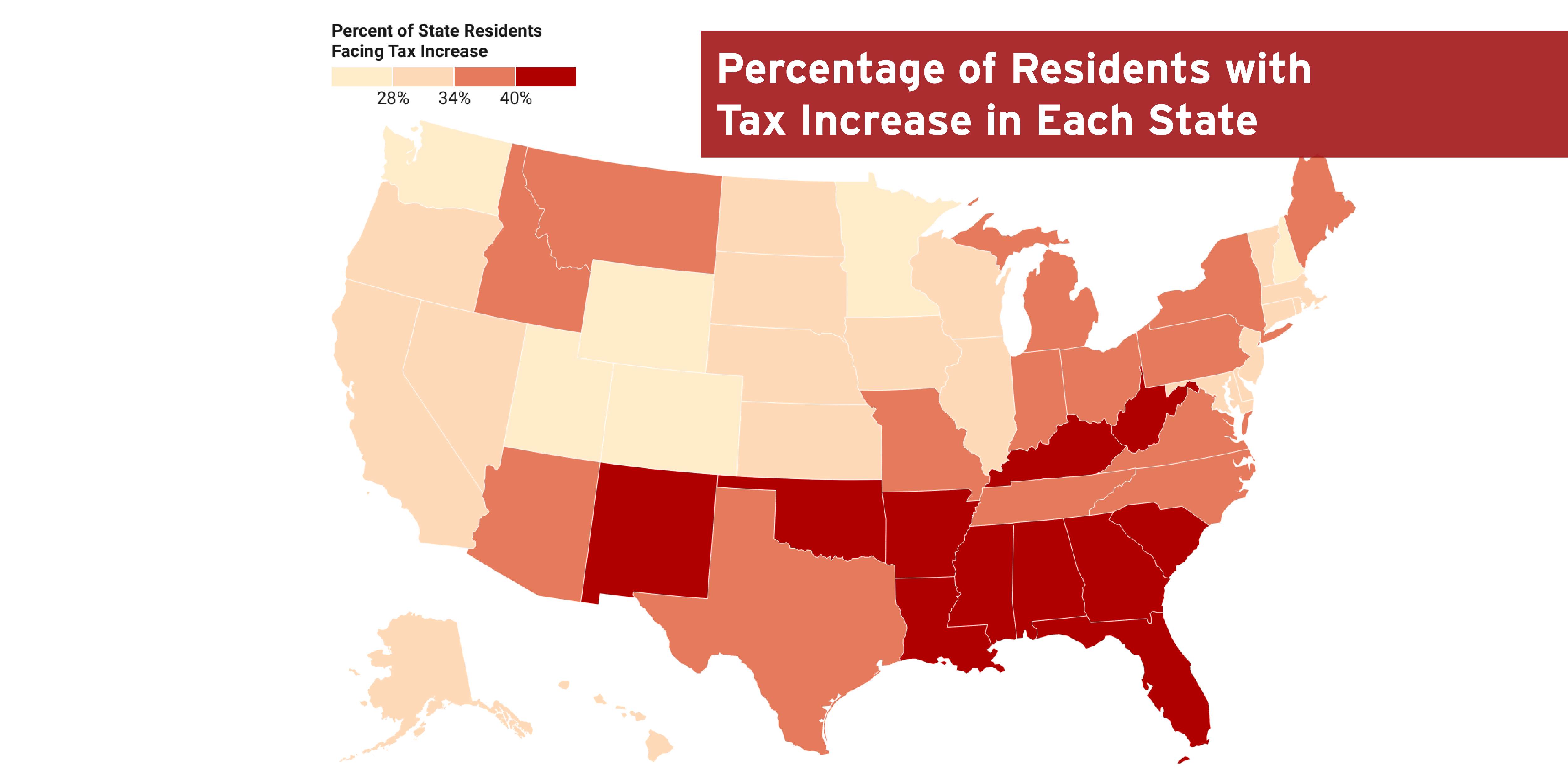

Punching The Meal Ticket Local Option Meals Taxes In The States Tax Foundation

New Hampshire Income Tax Calculator Smartasset

Flush States May Exempt Food From Sales Tax